The TPM PPDP solution is designed to provide European private wealth investors with diversified exposure to private debt with appropriate liquidity.

This week Truffle Private Markets Group, a leading provider of private markets solutions and partner to wealth managers and family offices across Europe, today announces its new name Troviq Private Markets.

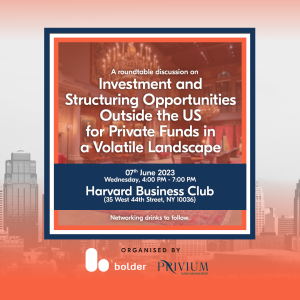

The name change coincides with the launch of the new TPM Privium Private Debt Portfolio (PPDP), launched in partnership with Privium Fund Management B.V. as the Alternative Investment Fund Manager, to provide investors with highly diversified exposure to the private debt market.

Through a single allocation, the PPDP will provide investors with a complete private debt portfolio which has typically been challenging for wealth managers and retail investors to access and can be a costly and capital inefficient investment strategy to replicate. The new fund aims to overcome this by providing efficient deployment and re-investment of capital, with appropriate liquidity.

PPDP will also offer an investment strategy that delivers diversification across sectors and managers via hundreds of underlying senior secured private loans across North America and Europe. This focus on senior secured, floating rate loans to mid-market corporate borrowers will provide protection and limit loss rates, while aiming to generate returns comparable to median private equity portfolio returns but with a much lower risk exposure.

In addition, the portfolio will contain a significant allocation to secondary transactions, providing exposure to opportunistic secondaries for investors, alongside GP Separately Managed Accounts and single loan co-investments.

Jason Proctor, Founder and Managing Director of Troviq, said: “We’re excited to be able to reveal our new name as we look to the future and continue our focus of working with our partners to develop private markets programmes that meet the investment objectives of their end-clients. To this end, we are delighted to launch this new private debt portfolio enabling access to this market for new and existing partners.

“Private debt strategies have become increasingly attractive for investors across the spectrum, especially as they look from increased diversification across asset classes and strategies. In the high interest rate and volatile environment we find ourselves in, investing in private debt can provide downside protection, low volatility and low correlation to traditional asset classes, making it an attractive proposition for investors.”

For questions on the TPM Privium Private Debt Portfolio, contact Robert-Jan van Hoorn of Privium Fund Management in Amsterdam.