Privium is the investment manager for the future to get you further to cope with your challenges to benefit from future opportunities

Privium Fund Management is a leading professional services organisation

with a proven track record in regulated investment management solutions

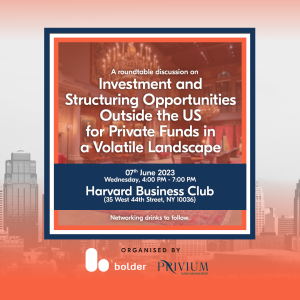

New York

- Investment Management Consulting

- Fund Structuring Consulting

- Fund Management Services

- Market access into Asia

- Market access into United Kingdom and the EU

London

- Regulatory Hosting

- Investment Management

- Appointed Representative

- Fund Management Services

- Compliance & Risk Management Services

- Financial Promotions Support

Hong Kong

- Investment Management

- SFC Licensed Representative (Type 9)

- Fund Management Services

- Compliance & Risk Management Services

- Marketing and Distribution Services

Amsterdam

- Authorised and regulated by the Dutch Authority for the Financial Markets

- Full scope AIFMD permission

- License for management of funds

- Variety of liquid and illiquid strategies

- Strong focus on Impact and ESG strategies

Singapore

- Investment Management

- RFMC Registration with MAS

- Fund Management Services

- Middle Office & Risk Management Services

- Marketing and Distribution Services